ASIA Retail & Consumer Trends 2023

Photo Credit: Karolina Grabowska

What a year 2022 has been?! A surge in inflation, China’s strict pandemic control measures, Russia’s invasion of Ukraine, and the collapse of the centralised crypto exchange, FTX. Despite all the headwinds, Asia reported positive business growth, particularly in India and Southeast Asia.

Looking into 2023, we can see some challenges in the first half of the year and many promising areas where retailers can focus to thrive in this economy. Generally, the consumer sentiment in Asia is optimistic, footfall is returning to the physical stores, stickiness has been built around e-commerce, and there has been a huge shake-up in customer loyalty.

In 2023, eMarketer predicted, the total retail sales in Asia will reach $12.82 trillion, growing at 5.6%. E-Commerce sales is predicted to reach $3.84 trillion and will grow about 10.5%. Out of the total e-Commerce sales, $3.08 trillion will come from mobile commerce, which is expected to grow to 11.2% in 2023. This will make mobile commerce contribute 80.3% of the total e-Commerce sales in Asia.

So, what is out there for Asia retailers in 2023? Where should they focus to seize the opportunity in this economy? Let us dive in to learn more about the top 5 trends in retail and consumer market in Asia in the year 2023.

1. Inflation: The tale of two key consumer personas

Asia has seen the highest inflation point in Q4 2022; however, the impact of inflation still looms, and consumers are feeling the pain of inflation going into 2023. Some economies have seen a lower inflation rate such as China and Japan, and some higher inflation rates, such as Singapore, Australia, and India.

We will see two very different consumer behaviour amongst the lower income bracket and the higher income bracket consumers. The lower income bracket consumers will opt for white-label and re-commerce to curb their expenses. You can see brands such as 7-Eleven, Coles and many other retailers doubling-down their investment in private labels as it brings better margins, and helps consumers gain better value for their money. This gives rise to a win-win proposition which will pose strong growth in 2023. On the re-commerce front, Carousell has partnered with Ikea Singapore to launch a temporary second-hand showroom and reward program. This shows that re-commerce will be picking up in 2023 to reduce consumer expenses and protect the environmental impact.

On the other hand, the higher income bracket consumers will spend more on health and wellness related products and services and will splurge on luxury items. According to eMarketer, health and personal care category will rise to #2 spot, with a growth of 18.4%. Luxury brands such as LVMH, Versace, are reporting strong sales, higher profit margins, and their business is growing double-digits. Moreover, many luxury brands are reducing their production capacity, which has made luxury goods being out-of-stock in many markets.

Photo Credit: YOUTHOPIA/NICKI CHAN

2. Shoppertainment: Unlocking the next trillion commerce opportunity in Asia

According to the study conducted by TikTok and Boston Consulting Group (BCG), Shoppertainment could uncover $1 trillion in market value for brands in Asia by 2025. BCG also predicted that Shoppertainment could grow at a 63% CAGR in Asia.

So, what’s shoppertainment? Shoppertainment is content-driven commerce that seeks to entertain and educate first while integrating content and community to create highly immersive shopping experiences.

TikTok launched social-commerce shopping capability late last year. TikTok users can follow brands, browse products they publish, and purchase them through the in-app feature known as TikTok Shop.

In addition, conversational commerce which is a huge part of social commerce is picking up its fumes. It is not surprising that consumers shop any time they want, and with that they expect to get answers instantly which can be achieved via AI driven chat-bots, but that is not enough. Consumers are expecting to complete their purchase without having to leave the platform. JioMart India is a great example of a brand that is delivering on this promise in partnership with WhatsApp from Meta. Consumers can start their shopping journey on WhatsApp. They can browse through the products, add the products they want to the cart, and seamlessly check-out to complete their purchase. This will completely change the way consumers interact with brands in 2023.

Photo credit: Meta (formerly Facebook)

3. Metaverse in Retail: A shifting interest and the comeback of augmented reality

In 2022, brands jumped on the Metaverse bandwagon due to the fear of missing out (FOMO). The interest of brands in Metaverse is slowly shifting as they see metaverse as a far-future concept which will take time to become a reality and have a mass-adoption. However, in 2023 we will see retailers and brands invest in the use cases that provide real business values.

We will see retailers invest in metaverse, AR/VR experiences in the new hybrid workplace environment. A few examples are employee onboarding, training, skills development, and remote assistance. By investing in the innovation for employees, retailers will not only attract new talent within younger generations, but also retain top performers.

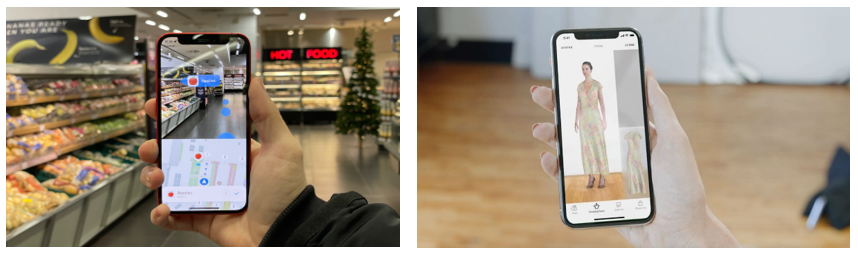

Augmented Reality (AR) and Virtual Reality (VR) were hot trending topics back in 2020 and 2021, before the metaverse trends flooded in 2022. However, in 2023 we may see a comeback of AR/VR technology since consumers already own high-spec mobile devices. Some interesting use cases could be in in-store product visualisation, virtual try-on, in-store navigation, and personalised shopping experience. Retailers are on a spree of optimising for cost, by investing in AR/VR technology they will be able to reduce the rate of product returns, increase customer satisfactions and uplift in the profit margins.

Photo credit: Dent Reality and Reactive Reality

4. Green Supply Chain: Optimising to reduce the environmental impact and cost

Supply chain trends in 2023 will be about cost optimisation and going green. Due to the pandemic in the last two years, there has been a surge in demand from online orders. In that race, retailers, logistics companies, and quick-commerce players have invested to expand their warehouses, automated them with robots, and added last-mile delivery fleet.

Going forward they will look for ways to better optimise their supply chain for cost and reduce greenhouse gas emissions. Retailers will invest in advanced-analytics technology to help optimise the supply chain in areas such as forecast and demand planning, delivery route optimisation, inventory optimisation, and empowering their frontline workforce for productivity and efficiency.

A study from McKinsey & Co shows that supply chain operations contribute up-to 80% of greenhouse gas emissions. In 2024, public listed companies and big companies may have to submit a mandatory emission report to the Securities and Exchange Commission (SEC). Retailers will start to invest in tools that will help them record and automatically generate emission reports. Furthermore, they will strategize and invest to reduce, replace, and remove greenhouse gas emission from their supply chain to achieve their green supply chain aspiration.

Photo Credit: McKinsey & Co

5. Retail monetisation: The end of 3rd party cookie and app tracking transparency

Identifying new revenue streams has always been at the top of mind for CEOs. There are multiple ways that retailers can monetise within their existing business. One of the most promising ways is to build an advertising platform and sell placements to CG/Brands to target their audiences. In 2023, retailers will be extending their advertising placements to off-site inventory via connected displays and electronic shelves within their physical stores.

While Apple has implemented app tracking transparency (ATT) in April 2021 to protect user data from app developers to leverage to track and target them. Google has deferred phasing out its 3rd party cookies in Chrome to 2024. Going forward in 2023, Retailers must build their own 1st party customer data platform and strategize around privacy and consent-based marketing approach. This will help retailers build trust and loyalty with their customers. Retailers can leverage 1st party data by using advanced analytics to deliver highly personalised recommendations, next best action for their employees, and predict customer churns. These capabilities will help retailers improve conversion rate, increase average order value, and build a higher customer lifetime value.

Photo Credit: FamilyMart Japan

In summary, 2023 will be the year of savings and cutting down on unnecessary expenses for consumers in ASIA. Retailers will be going through cost optimisation on multiple fronts especially in their supply chain operations. Brands will come up with creative ways to target different profiles and segments of consumers from health conscious to value-driven buyers. Retailers will also be implementing growth and monetisation strategies to seize market opportunity. Some examples are social commerce, retail media networks, and 1st party data monetisation.

Sources: eMarter.com | Carousell | CNBC | TikTok | Meta (Facebook) | McKinsey & Co | Washington Post | CNBC | TikTok | FamilyMart